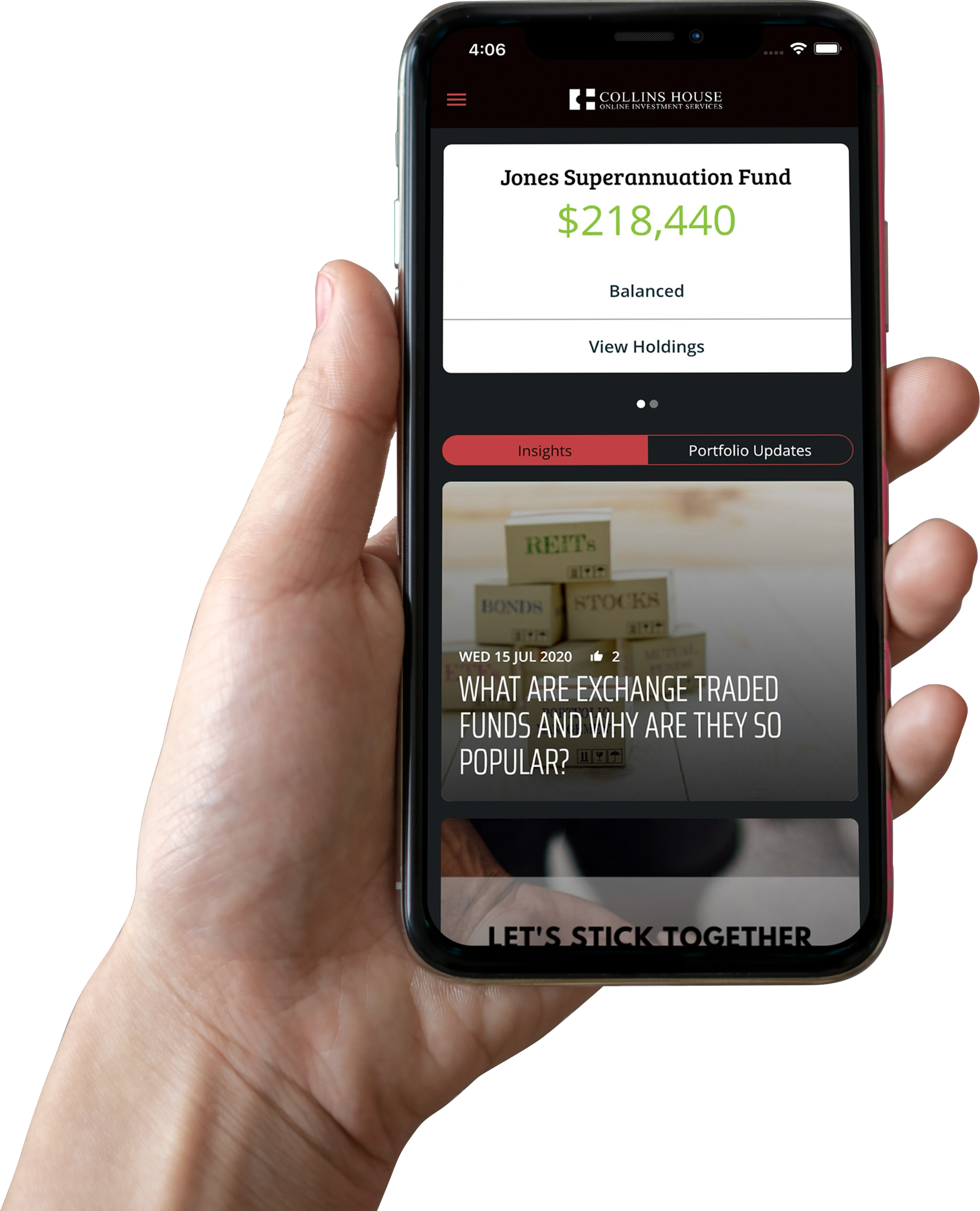

Collins House Online Investment Service (CHOIS) is a simple way for everyday Australians to access diversified portfolios that are professionally managed and low cost.

At CHOIS we offer the choice of 6 different investment portfolios including;

- High Income

- Moderately Defensive

- Balanced

- Growth

- High Growth

- Socially Responsible Balanced

You choose the portfolio that best suits your risk profile and time horizon. It’s as simple as that.

CHOIS is managed by Dominic Alafaci, one of Australia’s most respected, independent financial advisors who has been providing investment and financial advice since 1984.