Find the answers to our most asked questions

Dominic Alafaci established Collins House in 1992, creating a multidisciplinary financial advice firm that today is one of only a handful that specialises in providing Independent Financial and Investment advice. The firm provides a range of services encompassing superannuation, taxation, accounting, and estate planning.

Collins House Online (Collins House Online Investment Services Pty Ltd, ACN 620 936 567, ABN 30 492 640 027 Trading as Collins House Online, is a Corporate Authorised Representative of Collins House Private Wealth Pty Ltd ACN 166 528 758 Australian Financial Services Licence Number 449 146) began in 2017, in response to the demand from large sections of the public wanting an online general advice solution that was low cost and easily accessible.

Our philosophy is a simple one. Investing does not need to be complex and intimidating. We offer an easy-to-use online system for people wanting to access professionally managed diversified portfolios.

Professionally managed portfolios – We offer the choice of 6 different investment portfolios;

- High Income

- Moderately Defensive

- Balanced

- Growth

- High Growth

- Socially Responsible Balanced

All of our portfolios are diversified across different asset classes such as Australian shares, global equities, fixed income, listed property, emerging markets, infrastructure, commodities and cash.

Tax reporting – We provide you with an end of year tax summary which can be directly inputted into your tax return or given to your accountant.

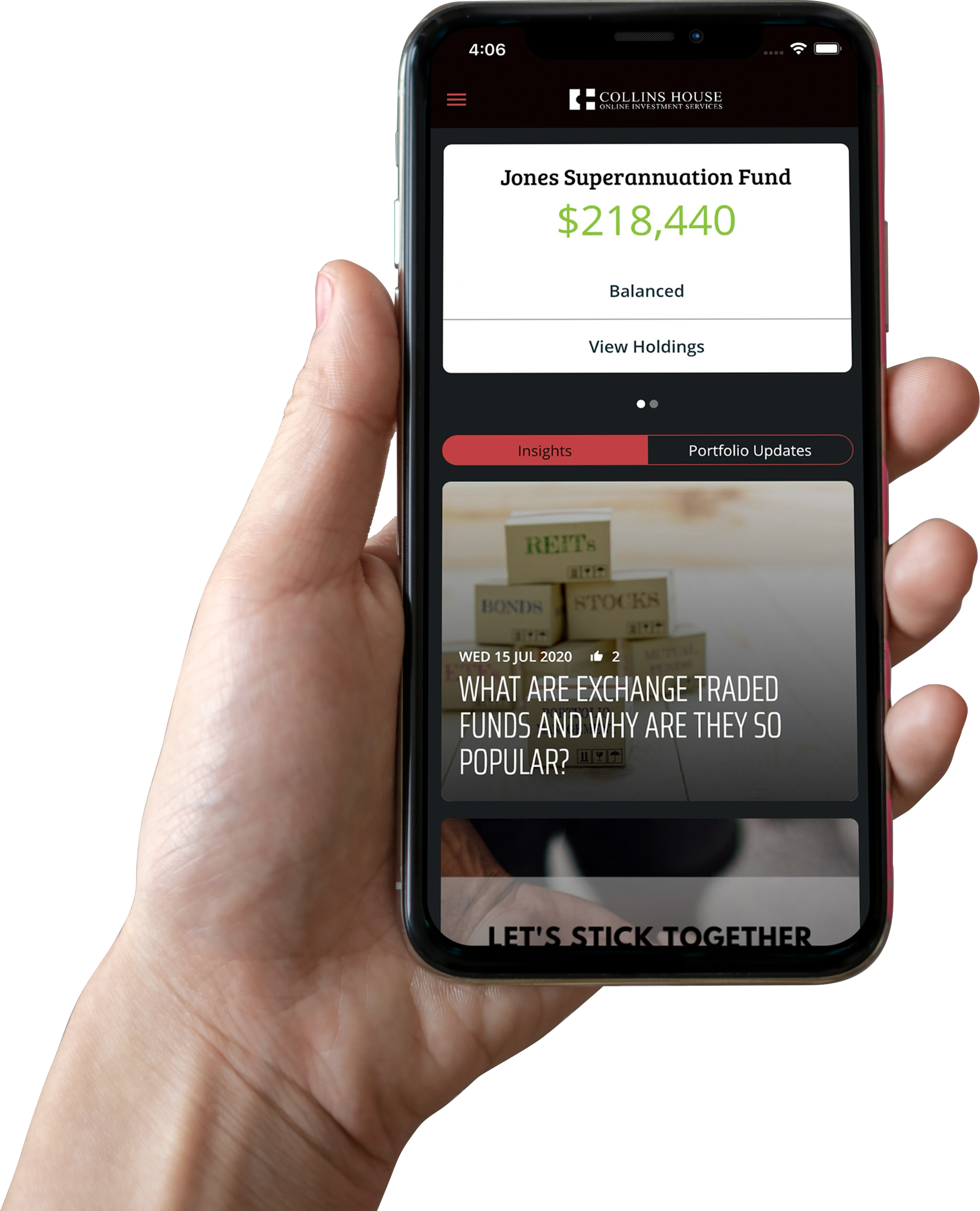

Client portal and app – Our client portal allows you to securely login to your account 24/7 and see how your portfolio is performing as well as receive regular updates from the Collins House Investment Committee. Clients also have access to the Collins House Online app.

Simple to set up – Open an account online in under 5 minutes

Low minimum to begin – You can start with as little as $5,000

Competitive fees – The headline fee for portfolios up to $500,000 is 0.75% pa (discounts apply for amounts over $500,000)

Experienced investment committee – Our investment team has over 60 years of combined experience in financial markets and managing investment portfolios.

Proven investment strategy – Our portfolios can provide both growth and income.

No other fees – no hidden or additional fees like performance fees or withdrawal fees.

Beneficial ownership – All investments are beneficially held by the investor.

Online access anytime – access and reporting via our online portal or mobile app.

Whilst all of our portfolios aim to minimise risk of any capital loss by diversifying across different asset classes and also within those asset classes, an investment in our portfolios is not capital guaranteed. Unlike a bank which provides a capital guarantee of up to $250,000, there is a risk of capital loss in all of our portfolios.

Collins House Online provides General Advice only. This means the information provided on our website has been prepared without taking into account the investment objectives, financial situation or needs of any particular investor.

Before acting upon this general advice, people should consider the appropriateness of the advice, having regard to their objectives, financial situation and needs. Please read our Product Disclosure Statement and Financial Services Guide before investing in one of our products.

All of your investments are legally held on trust by the custodian, Link Fund Solutions (a wholly-owned subsidiary of Link Group, a market-leading provider of technology-enabled solutions to the financial and corporate markets) but beneficially owned by you and kept separate to the portfolios of other investors. In the extreme and unlikely event that something happened to Collins House, your securities would be safely held on your behalf by the custodian.

Collins House Online uses OpenInvest Limited https://www.openinvest.com.au/ to provide the investment platform. They host the technology and undertake all trading as directed by the Collins House Investment Committee.

If you have the experience, expertise, and time to monitor your portfolio and to rebalance it in response to market movements, then self-managing your portfolio is certainly an option.

However, we have built Collins House Online for the vast majority of people who don’t have the time or expertise to do it themselves.

Simply choose the portfolio that best suits your risk profile and time horizon and complete the short account opening process. You will then be asked to transfer funds which we will draw upon to build your portfolio.

Yes, you can. We understand that banks often impose a daily transfer limit and also some people may want to transfer their initial deposit from multiple bank accounts. There is no need to transfer your funds in a single transaction.

Our minimum investment is only $5,000.

Yes, it is certainly possible to invest in more than one model portfolio but you will need to open up a new account for each portfolio. For example, if you wanted to invest some funds under your personal name in both a High Income portfolio and Growth portfolio then you would need to open an account for each. To invest in more than one Model Portfolio please follow this process :

Step 1 – Open your first account as per normal

Step 2 – Login to your Investor Portal

Step 3 – Click Create Account

Step 4 – Click on Invest next to the portfolio you wish to invest in

Step 5 – Complete each step of the application

Yes, it is certainly possible to invest in both your personal name and your SMSF but you will need to open a new account for each portfolio. This also applies if you wanted to open an account for each of your children and you want to choose either the same or a different Model Portfolio per Account. To do so please follow this process :

Step 1 – Open your first account as per normal

Step 2 – Login to your Investor Portal

Step 3 – Click Create Account

Step 4 – Click on Invest next to the portfolio you wish to invest in

Step 5 – Complete each step of the application

Yes, it is possible for a parent or relative to open an account on behalf of a child or grandchild who is aged under 18. When opening your account please follow these steps :

- in Step 2 of the application process, “Choose your Account Type” please select “‘”On behalf of a Minor” (under 18 years of age) and then either “Minor with no Trustee” or “Minor with existing Trust“.

Please note that the Investment Portfolio will be legally held in your name even though it is designated to your child or grandchild. Minors (those under the age of 18) cannot legally own investments in their own name.

Yes, when opening in account you can select this option when choosing the type of account.

Yes, you can make additional contributions to your investment portfolio at any time by depositing funds via BPAY or Direct Credit to our administrator and custodian. If you wish to do so, please log in to the Investor Portal and follow these steps:

- Click on the Account you wish to make additional contributions into on the right side of the screen.

- Click Contribute and enter the amount you wish to invest and the payment method.

We ask for your Tax File Number (TFN) so that we don’t have to deduct withholding tax from your investment returns.

Providing your TFN is not compulsory, it just means that without it we have to deduct tax, which you may be able to claim back at a later day. You also have the option to provide a TFN exemption code if one applies to you.

Once your funds have cleared (usually 2-3 days) we will invest in the portfolio of your choice. We will email you when we first receive your funds and also when we invest them.

No you don’t, but you do need to be an Australian resident for tax purposes.

Collins House Online is currently available for the following accounts:

- Individuals

- Joint accounts

- Company accounts

- On behalf of a minor (under 18 years of age): as a “Minor with no Trustee” or “Minor with existing Trust”

- Trust Account with a corporate trustee

- Trust Account with an individual(s) as trustee

- SMSF Account with a corporate trustee

- SMSF Account with an individual(s) as trustee

A Product Disclosure Statement is a document that contains information about the service including its key features and benefits. It also provides details about the risks, costs and fees of the service as well as how it works and your rights and obligations as an investor.

We offer the choice of 6 different portfolios.

- High Income

- Moderately Defensive

- Balanced

- Growth

- High Growth

- Socially Responsible Balanced

Each portfolio is constructed from a list of ETFs and Managed Funds diversified across different asset classes.

Asset classes include:

- Australian shares

- Global equities

- Australian fixed interest

- International fixed interest

- Australian listed property

- Emerging markets

- Infrastructure

- Commodities

- Cash

An Exchange Traded Fund (ETF) is a type of investment fund listed on the stock exchange and traded like shares. Each ETF holds a collection of securities, the composition of which mirrors a particular index, such as the S&P/ASX 200 index of Australian shares.

ETFs allow individual investors to gain all the diversification benefits of owning a large number of securities while only having to hold one investment thereby lowering the investment amount needed to properly diversify. Since each ETF is designed to track a particular index, ETF fees also tend to be lower than for equivalent funds trying to beat indices.

We use a range of ETF’s and Managed Funds to represent the various asset classes that make up our portfolios. All of our Funds are chosen based on a number of factors including; fund size, liquidity, costs, tracking error and performance. We also aim to diversify our portfolios across different ETF issuers.

Yes. When opening your account, you can choose what percentage of the income (from 0% to 100%) you wish to receive, and the balance will be reinvested back into the portfolio. Alternatively, you can elect to receive a fixed amount quarterly which may consist of income and capital, which will be transferred into your nominated bank account every quarter.

No. You can withdraw your money at any time without penalty. Settlement usually takes 7 days although in certain circumstances we reserve the right to extend this period (reasons in which we might have to do so this are set out in the PDS). The majority of the funds we invest in are listed on the ASX which settle on a T+2 basis although a portion is likely to be unlisted which will generally take longer to settle.

Yes. You will be entitled to any franking credits that are attached to distributions. This will be detailed in the annual tax statement that we issue you.

When we purchase your portfolio, we leave a small amount (approx. 2%) in a separate cash account in order to pay your fees. This cash account is part of your investment account and accrues interest daily.

No, Collins House Online does not offer the capability for customisation of the portfolio.

You can generate ad hoc reporting by visiting the Investor Portal and selecting ‘reports’. Then select the report you wish to generate and the time period.

Reports available are: Cash Account Transactions, Expense Detail, Income, Portfolio Valuation, Realised Capital Gains Detail, Transactions, Unrealised Capital Gains Details, and Performance.

Annual reports will also be posted under ‘Documents’, such as:

- Annual Investor Statement (available in late August)

- Annual Tax Statement (available in early October)

- OpenInvest Annual Report (available in early November)

The majority of our chosen Funds pay quarterly distributions although in some cases it is half-yearly or monthly.

Our portfolios are approved and maintained by the Collins House Investment Committee. The Investment Committee has over 60 years of combined experience in financial markets and portfolio construction. Click here for further information.

Please click here to calculate your monthly fee. Your fees are based on the daily value of your investment account, calculated monthly in arrears and deducted directly from your cash account, which is a part of your investment account. For a more detailed breakdown of how your fee is calculated please see the PDS.

No, all gains are retained by the investor.

Transaction costs are charged to buy or sell assets in your account. These are charged as a percentage of the transaction value and deducted from your Account when any such transaction occurs. Please refer to the PDS to review these fees (Currently 0.1% capped at $9.50 per transaction for Domestic Securities and 0.15% or $14.50 per transaction for International securities. Transaction fees are effective from 1st January 2024.

No, there are no Entry/Exit Fees or lock-in contracts.

Every investor has access to their own investor portal so you can log in at any time and see at a glance:

- The overall status of your investment account

- The composition of your portfolio

- How your portfolio is performing

- Updates from the Collins House Investment Committee

We also provide investors with access to the Collins House Online app.

Yes, if you feel your circumstances have changed or perhaps you weren’t in the right portfolio to start with, you can change portfolios at any time via the client portal.

You can withdraw funds at any time via the following steps:

- Login to your client portal on your pc or tablet.

- Click on Account.

- Click on Withdraw.

The entire process normally takes between 7 and 10 days before the funds are back into your nominated bank account.

No, there are no penalties or costs involved no matter how long you have invested your funds. Transaction fees apply.

You can transfer additional funds or setup regular deposits at any time by visiting your online portal and clicking on the Account Maintenance tab in the menu and then ‘Contributions’.

The High Income Portfolio aims to provide regular income through investing in a diversified and actively managed portfolio of quality fixed interest investments.

We aim to provide an income return that is greater than bank term deposits by generally favouring fixed interest investments that deliver higher returns at an acceptable level of risk. However, with the higher rate of expected return comes higher expected risk, including the risk of capital loss.

Fixed interest investments, such as term deposits and government bonds offer investors a regular income for a specified term with the expectation that the principal will be repaid at the end of the term (maturity date).

Term Deposits are a deposit with a financial institution which has an agreed term (generally 1 month to 5 years) and interest rate (generally higher than an at call account but lower than other fixed interest investments). There are restrictions on how they can be terminated prior to the term. The chief benefit of a term deposit is that capital is guaranteed by the Australian Government, up to a limit of $250,000.

Bonds are securities issued by Governments or Corporations when they borrow money from investors.

Corporate Bonds generally pay a higher rate of return than Government Bonds and usually pay higher interest than term deposits to reflect the perceived higher credit risk.

Global bonds are usually fully hedged to the Australian dollar to remove any currency risk.

Residential Backed Mortgage Securities (RMBS) are another form of fixed interest investment and are made up of packages of home loans that are sold on by lenders to investors.

RMBS generally pay higher returns than Government Bonds and in some cases Corporate Bonds due to increased credit risk.

Fixed interest investments can be sold relatively quickly, although it’s important to note their capital value may rise and fall due to market conditions and assessed credit risk.

- Quarterly income distributions; we are targeting a distribution of over 3% p.a, (net of all fees) and paid quarterly – please note that this rate of return is not guaranteed and is determined by market conditions.

- Actively managed; we utilise a range of specialist Fixed Interest Managers to take advantage of expertise in both local and global fixed Interest markets and monitor the underlying portfolios and manager performance so as to minimise risk of any capital loss.

- Diversification; our portfolio is diversified in two crucial ways: first, it offers diversification across Government and Corporate Bonds as well as RMBS and other liquid fixed interest opportunities both in Australia and Internationally. Second, we select different Fixed Interest Managers to take advantage of their expertise across different markets.

- Easy access; it’s a quick and simple process to open an account and you can start with as little as $5,000.

- Regular updates; Our Investment Committee provides you with regular and timely updates on the performance of the portfolio

Whilst the High Income Portfolio aims to minimise risk of any capital loss by diversifying both across the various types of fixed interest investments and within those categories, an investment in the portfolio is not capital guaranteed. There is a risk of capital loss and/or of the portfolio not being able to pay the expected income distribution.

Investors and retirees seeking a higher rate of income return than is currently being offered by bank deposits and who fully understand and accept that this investment is higher risk than a term deposit. In particular, unlike an investment in a term deposit, an investment in our High Income portfolio is not capital guaranteed.

The minimum investment is $5,000, with the ability to add further amounts of $1,000 or more.

Income distributions (which consist of interest and realised capital gains) are paid quarterly around the following dates: January 30, April 30, July 30 and October 30.

Yes. When opening your account, you can choose what percentage of the income (from 0% to 100%) you wish to receive, and the balance will be reinvested back into the portfolio. Alternatively, you can elect to receive a fixed amount quarterly which may consist of income and capital, which will be transferred into your nominated bank account every quarter.

No. You can withdraw your money at any time without penalty. Settlement usually takes 7 days although in certain circumstances we reserve the right to extend this period (reasons in which we might have to do so this are set out in the PDS). The majority of the funds we invest in are listed on the ASX which settle on a T+2 basis although a portion is likely to be unlisted which will generally take longer to settle.

We charge a Management Fee of 0.75% p.a. which covers our investment management decisions as well as the platform administration costs. This fee is deducted directly from your account on a monthly basis.

There is also an indirect cost based on the underlying charges of the holdings we invest in, such as ETFs and managed funds. These charges are automatically deducted from those funds and do not come out of your account.

For an estimate of your monthly charges please click here.

The Collins House Investment Committee manages the portfolio. The Investment Committee has over 60 years experience in financial markets and portfolio construction. Click here for further information.

The selection of the individual fixed interest securities is outsourced to external investment managers who have significant experience and expertise in managing fixed interest securities.

A new investor entering the High Income Portfolio during the quarter will have their accrued income paid out to them based on the time they have been invested in the portfolio. As an example, if you enter the portfolio 20 days before we pay income out for that quarter, then you will only be entitled to any interest, dividend or distributions paid by the underlying funds or ETFs for the quarter, in that 20 day period in which you were invested.

For questions regarding the administration of your account, please contact our friendly team on 1800 861 016 or support@collinshouseonline.com

Yes. If you wish to speak with one of our portfolio managers you can contact us on (03) 80807838 or chois@collinshouse.com